7 Budgeting Tips to Make the Most Out of Your Money

Creating a household budget is a sensible and simple way to help allocate your hard-earned income. Get these 7 budgeting tips to ease the financial stress.

We all love to save money, especially when it comes to home and auto insurance. According to U.S. News & World Report, the national average cost of auto insurance is about $2,068 per year, while USA Today reports the national average for home insurance can range from $1,117 to $2,950 per year. These costs can add up over time, but with the right strategies, you can save on these necessary expenses.

With Mercury’s resources, you’ll have the tools and knowledge to make smart decisions that keep more money in your pocket while ensuring your home and vehicle are fully protected. We provide information on how to find cheap auto insurance by comparing quotes and taking advantage of various auto insurance discounts, from safe driver discounts to multi-car savings. If you’re looking to protect your home, we also offer tips on finding cheap homeowners insurance, exploring how factors like your home’s location, safety features, and coverage options can impact your rates.

If you need more information on how to save on insurance, don’t hesitate to reach out to a Mercury agent. They can provide personalized advice on how to lower your premiums, explore auto insurance discounts, and find the best ways to bundle home and auto insurance.

Creating a household budget is a sensible and simple way to help allocate your hard-earned income. Get these 7 budgeting tips to ease the financial stress.

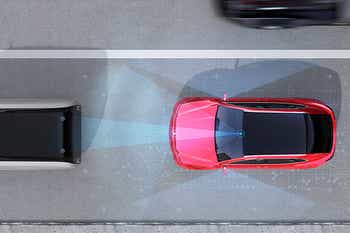

Many technological advancements have a significant impact on your insurance rates. Learn what 5 things you should tell your insurance agent.

A car is one of the biggest purchases you’ll make in life, and purchasing a used vehicle can be a great way to get the most for your dollar. Don’t hastily jump into a deal before searching around and doing your homework on what a car is truly worth.

Typically, drivers involved in a collision exchange vehicle and insurance information with one another. But what does one do when there’s no driver in the automated vehicle?

Vehicle safety should be a priority when making a purchase decision with college students. Learn more about the safest and most affordable vehicles to insure.

Health and wellness are key to a happy life. Mercury Insurance helps its customers find an auto policy that gives time to focus day-to-day well-being.

Here are the most common types of homeowners insurance claims and some tips to help protect your property from these losses.

Homeowners Insurance protects you and your home. Here are 5 things your homeowners insurance policy should cover if an unexpected loss were to happen.